The government is prioritising protecting domestic vehicle production and exports over promoting electric vehicle use

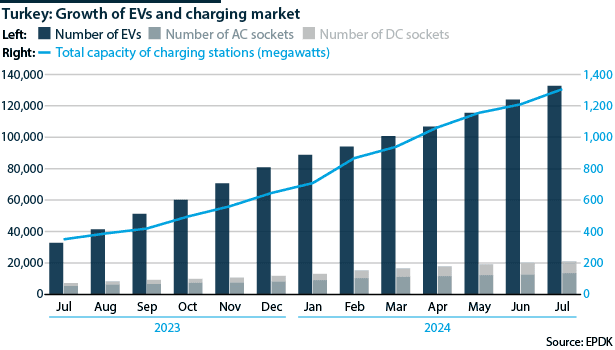

Turkey’s automotive manufacturing association downgraded its 2024 production and export forecasts on October 14. Between July 2023 and July 2024, the number of electric vehicles (EVs) on Turkey’s roads increased by over 300% and the number of public charging sites increased by 270%. Growth occurred despite very weak incentives promoting EV sales (and no legislation limiting emissions), and despite legislation and financial penalties designed to limit EV imports.

What next

Subsidiary Impacts

- The strong lira will disincentivise export-driven manufacturing investment.

- Ankara will face pressure to increase incentives to purchase EVs to help meet its targets under the Paris Accord.

- There will be consolidation and rationalisation of the EV charging sector.

- China’s BYD will push ahead with developing its 150,000 unit-per-year EV plant, scheduled to commence production in 2026.

Analysis

The number of vehicles on Turkish roads has more than tripled between 2002 and 2024 to over 30 million, while the sector contributed around USD11.4bn in exports in 2023.

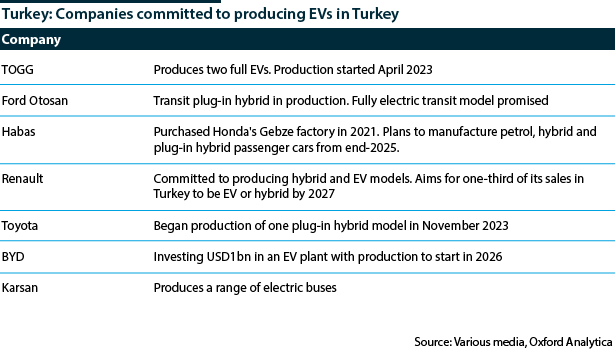

There are currently 13 vehicle manufacturers, of which eight are global companies and five local, with China’s BYD having committed to becoming the 14th. In addition, there are over 1,100 component manufacturers with production facilities in Turkey, many of them also global players. Some have begun producing batteries and other EV components for both domestic models and export.

Outwardly Ankara is committed to the transition to EVs, but its main aim is to protect the domestic vehicle manufacturing sector by urging existing manufacturers to produce EV models in Turkey and encouraging others to establish manufacturing plant in the country.

In June 2024, Ankara followed the EU in imposing a 40% import tariff on Chinese vehicles (conventional and electric), with a minimum tariff of USD7,000 per vehicle (see EU/CHINA: Tariffs on electric vehicles remain likely – September 18, 2024).

Several existing manufacturers have either started or committed to producing hybrid and/or EV models in Turkey. The overwhelming bulk of production is still of fuel-burning models, especially commercial vehicles, which account for around 48% of the vehicles on Turkish roads and almost all the vehicles produced for export.

Turkish EV market

In the year to August 2024, the number of EVs on Turkish roads (all passenger cars) increased by just over 234% while the number of charging sockets available rose by 170% to 22,485.

Although impressive, the rapid growth is due in part to a low base effect, coupled with ‘seeding’, which boosted sales of Turkey’s domestically designed and manufactured TOGG EV passenger models.

EV penetration remains low without government support

EV sales remain a very small part of the Turkish market for passenger cars. Passenger car sales between January and August 2024 totalled 605,639, of which 13.9% were hybrid and 8.3% fully electric. Of the 15.9 million passenger cars on Turkish roads at the end of August, 2.0% were hybrid and 0.9% fully electric.

The TOGG Effect

Created through a joint venture of six Turkish groups, two of which were state-controlled, TOGG produces just two EV models, the first of which was put on the market in limited numbers from March 2023. It will begin exporting vehicles in 2025 and aims to produce 1 million vehicles per year by 2030.

TOGG EV models accounted for 33% of the 42,736 EVs sold between January and July this year — around three times the proportion of each of its nearest competitors, BMW (11.3%) and Tesla (10.7%).

However, it is unclear to what extent TOGG sales were genuine. An unknown number of vehicles were distributed to ‘influencers’ ahead of Turkey’s local elections in March 2024, which, coupled with overtly nationalist marketing, led to a surge of media interest. In August, TOGG accounted for just 10.6% of the total EV sales of 5,662, behind Tesla (18.5%) and level with Hyundai.

TOGG may face an uphill struggle to maintain domestic interest in its national car, and to generate export sales. Traditionally, Turkish passenger car buyers prefer higher specification European- and Japanese-manufactured vehicles, with imports regularly accounting for 70% of sales. It will also take time to establish a dealer and service network outside Turkey.

Charging station operators

‘The Turkish Energy Market Regulatory Authority (EPDK) has issued 198 licences to charging station operators since May 2022. Licence holders must establish a chain of 50 charging points — capable of charging all EV models, without prior subscription — in five regions within six months of receiving the licence.

Already, 28 licences have been cancelled, and it is unclear how many of the remaining 170 are active. EPDK’s July 2024 EV sector report lists the ten largest operators, which account for almost half of the 21,070 charging sockets available.

Turkish EV owners complain that there is no ‘umbrella app’ for all charging operators and that charging cost varies enormously between operators.

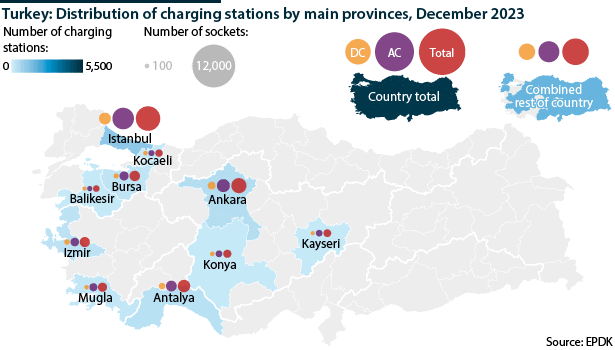

Public charging points are located primarily in the western cities

The majority of charging stations are located in car parks and shopping malls in the main population centres in western Turkey. There has been discussion of support mechanisms to ensure charging stations are made available in rural areas.

Turkey’s climate change strategy

Turkey’s Nationally Determined Contribution (NDC) under the Paris Accord is for a 41% reduction in greenhouse gas emissions compared with the business-as-usual scenario. Further targets are peak emissions by 2038, at the latest, and net zero by 2053.

Critics question Turkey’s commitment to these targets, citing the continued development of hydrocarbon reserves and the lack of measures to boost EV sales (see TURKEY: Oil and gas industry looks set for growth – September 4, 2024 and see TURKEY/TURKMENISTAN: Iran gas swap could move quickly – April 25, 2024). Transport accounts for 16.0% of Turkey’s greenhouse gas emissions, of which 94.9% are generated by road transport.

With the government focused mainly on securing the long-term future of the Turkish automotive sector, there has been no discussion of introducing low-emission zones and only very limited financial incentives offered to EV buyers.

Commercial EVs are not being prioritised

In addition, there are virtually no commercial EVs and there has been no public discussion of how to boost their uptake.

Further tax breaks appear unlikely as long as the bulk of EV models on the market are imported.

Growth projections

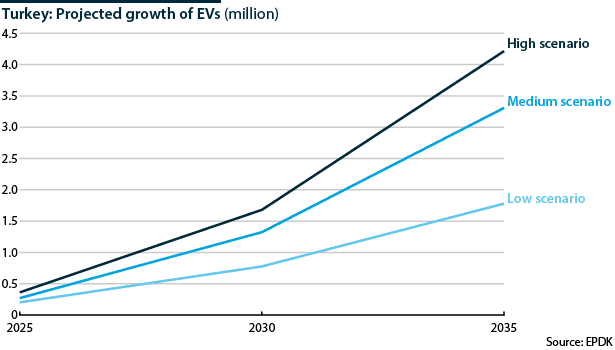

The Climate Change Mitigation Strategy and Action Plan suggests that by 2030 Turkey will have 2.5 million EVs, of which 35% will have been produced in Turkey, with 75% of their components also produced locally.

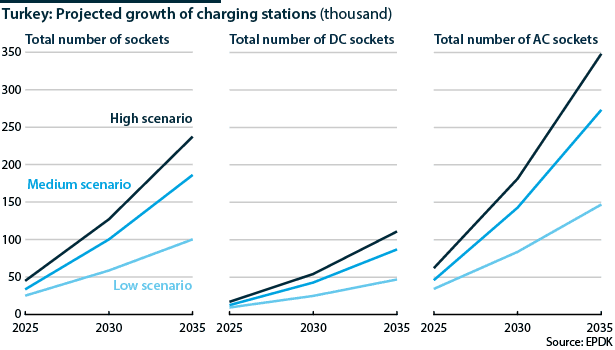

The EPDK offers three growth scenarios for EV and charging socket numbers by 2035, ranging from under 2 million to over 4 million EVs and between 100,000 and nearly 250,000 charging sockets.

EPDK predicts that even, in the high scenario, the ratio of electricity consumption of EVs to total electricity consumption will not exceed 1% in 2030 and 2% in 2035.

The agency indicates that the number of fast-charging DC sockets is increasing more rapidly than the number of AC sockets. This would appear to reflect the relative difficulty of longer charging sessions in public places.